Strategy ONE

Odd-first-period price

Returns the price per $100 face value of a security having an odd (short or long) first period.

Syntax

Oddfprice <Basis> (Settlement, Maturity, Issue, FirstCoupon, CouponRate, YieldRate, Redemption, Frequency)

Where:

Settlement is the settlement date. This is the date, after issue, on which the security is traded.

Maturity is the date of maturity. This is the date on which the security expires.

Issue is the issue date.

FirstCoupon is the first-coupon date.

CouponRate is the annual interest rate of the coupon.

YieldRate is the annual yield.

Redemption is the redemption value per $100 of face value.

Frequency is the number of coupon payments per year. The valid values are 1, 2, and 4 where annual payments =1, semiannual payments =2, and quarterly payments =4.

Basis is a parameter that indicates the time-count basis used. The default value for Basis is 0, which is typically used by American agencies and assumes 30-day months and 360-day years (30/360). Possible values for this parameter are listed in the following table.

| Basis value | Application |

|

0 (30/360) |

Assumes 30 days in each month, 360 days in each year. |

|

1 (actual/actual) |

Assumes actual number of days in each month, actual number of days in each year. |

|

2 (actual/360) |

Assumes actual number of days in each month, 360 days in each year. |

|

3 (actual/365) |

Assumes actual number of days in each month, 365 days in each year. |

|

4 (30/60) |

Used by European agencies, assumes the same values as “0” for American institutions. |

Expression

There are two expressions for this function:

- Odd Short First Coupon: for securities with a short first period

- Odd Long First Coupon: for securities with a long first period

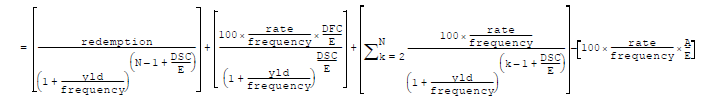

Odd Short First Coupon

Where:

A is the number of days from beginning of coupon period to settlement date (accrued days)

DSC is the number of days from settlement to next coupon date

DFC is the number of days from the beginning of odd first coupon to first coupon date

E is the number of days in coupon period

N is the number of coupons payable between settlement date and redemption date; if this number contains a fraction, it is raised to the next whole number

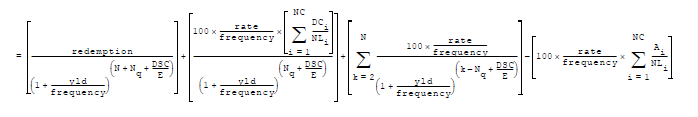

Odd Long First Coupon

Where:

Ai is the number of days from beginning of the ith quasi-coupon period within odd period

DCi is the Number of days from date to first quasi-coupon (i=1) or number of days in quasi-coupons (i=2,..., i=NC)

DSC is the Number of days from settlement to next coupon date

E is the Number of days in coupon period

N is the Number of coupons payable between the first real coupon date and redemption date; if this number contains a fraction, it is raised to the next whole number

NC is the Number of quasi-coupon periods that fit in odd period; if this number contains a fraction it is raised to the next whole number

NLi is the Normal length in days of the full ith quasi-coupon period within odd period

Nq is the Number of whole quasi-coupon periods between settlement date and first coupon

Usage Notes

The Settlement date and the Maturity date should be included within single quotations in the expression for the expression to be considered as a valid expression.