MicroStrategy ONE

Net present value (of an investment)

Returns the net present value of an investment based on a discount rate and a set of future payments (negative values) and income (positive values).

All payments and incomes must be equally spaced in time, and occur at the end of each period. To calculate the net present value of an investment in which payments and income do not occur at regular intervals, see XNPV (net present value of an investment for payments or incomes at irregular intervals).

Syntax

NPV <FactID, SortBy> (Argument, Rate)

Where:

FactID is a parameter that forces a calculation to take place on a fact table that contains the selected fact.

SortBy is a parameter that defines the order of calculation. For more information see BreakBy and SortBy parameters.

Argument is a fact or metric representing a list of values containing either payment or income figures.

Rate is the discount rate for the length of a period.

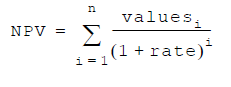

Expression

Where:

n is the number of entries in Values.

Usage Notes

All entries in Values must be equally spaced in time, and occur at the end of each period.

The order of the entries in Values is assumed to be the order in which funds flow; payment and income entries must, therefore, be provided in the correct sequence.

Investment begins one period before the date on which the first entry in Values occurs, and ends with the last entry in that array.

If the first entry in Values occurs at the beginning of a period, it must be added to the result of the function.

The primary differences between this function and the Present Value (PV) function are that

- PV allows fund flow to occur either at the beginning or at the end of a period.

- PV fund-flow occurrences must be constant across the life of the investment.